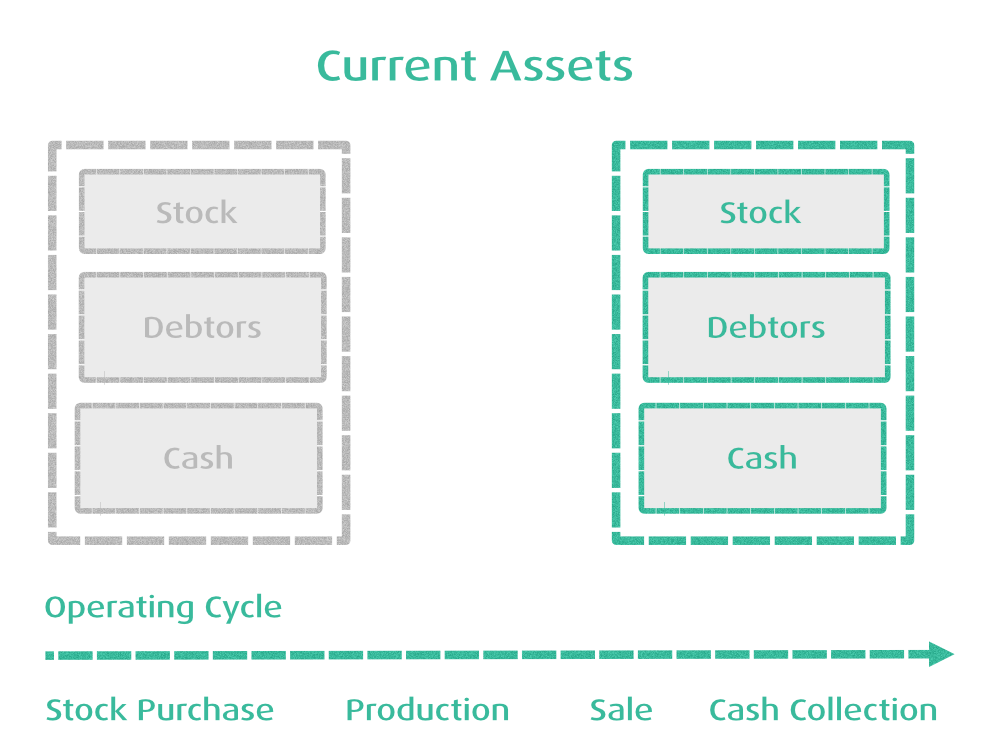

The operating cycle of the business includes all activities which can be classified as input buying of the 'stock', adding value to it, and selling the products or services to generate profit (with associated activities to enable sales), followed by the cash collection from customers.

The other cycle differentiated in the business activity is the investment cycle - purchasing tools, and means for production, or service delivery. We have described this process in the previous posts.

The operating cycle is mapped in the Current Assets section of a balance sheet. The lines of the section are usually sorted according to their liquidity. This section allows us to understand working capital requirements, as we see shortly, understanding the length of the operating cycle is a key information point to know how much money the business needs to fund its operations.

Assuming a very simple model, where a business needs 3 months to produce and expedite a bigger order, and it will take another month for the money to appear in the bank, we can clearly see that taking into account the fact that realistically the cycle can repeat 3x times per year (assuming holiday, illness and other factors), then a fictitious company will need a working capital equal to 4 months of operation, plus all the material costs, assuming a full recovery after each sale, and some profit margin.

As reference [1] explains, for every one pound placed in the business operating cycle, cash is recovered after some time period. In our example it is 4 months.

This measure is referred to as a working capital requirement.

Once we understand the cycle, it is clear that all we need to look at is

- Stock

- Debtors

- Cash

which tells us a lot about the overall story behind the business.

Depending on the amount of the annual sales are "frozen" in the inventories, work in progress, customer receivables, and account payables, we can calculate the ratio.

Working Capital [%] = Operating Working Capital / Total Sales

As a business owner, the main concerns can be two the requirement for the working capital is the first one. Each capital requirement costs money whether in the form of interest, or some other form. Including interest could make or break the business.

Finding some hidden advantages, to invoice, and cash customer upfront would be another option.

The reference [2] explains more on the subject in terms of growth, and recession. Both situations will check the company's ability to adapt itself to the conditions and manage the working capital requirements.

Finally, we will mention a few industry figures for the working capital ratios:

| Industry | Working Capital Ratio [%] |

|---|---|

| IT Services | 8% |

| Software | 5% |

| Consumer goods | 12% |

| Transport | -8% |

It is worth noting that companies able to cash upfront - such as transport, will have a negative working capital requirement.

References:

[1] Mastering Financial Management, Brookson S., 1998, London

[2] Corporate Finance, Quiry, P & all, 2005, Chichester