We know that the intangibles are notoriously challenging to develop and commercialise successfully. Speaking with a friend who works as an accountant, we discussed my recent post "Capitalizing on Software Development". He asked why the probability of losing the investment was so high for software, compared to other types of investment into physical goods or services.

Developing a technology, or even applying existing technologies to solve a problem in an innovative way, carries risks in terms of cost overruns, delays and failure to deliver value. We know all of these things from experience, but digging deeper reveals some interesting insights about how this risk manifests itself, which may help us understand what makes it different than developing tangible products.

As I learned examining the literature reference, a lot of research in this are was done by Baruch Lev, professor at Stern School of Business New York University.

Lev starts with dictionaries definition—intangible as "incapable of being defined or determined with certainty or precision". He then goes further and defines an intangible asset as a claim to future economic benefits that does not have physical or financial embodiment. Examples include patents, brands, and unique organisational structure—e.g. an Internet-based supply chain.

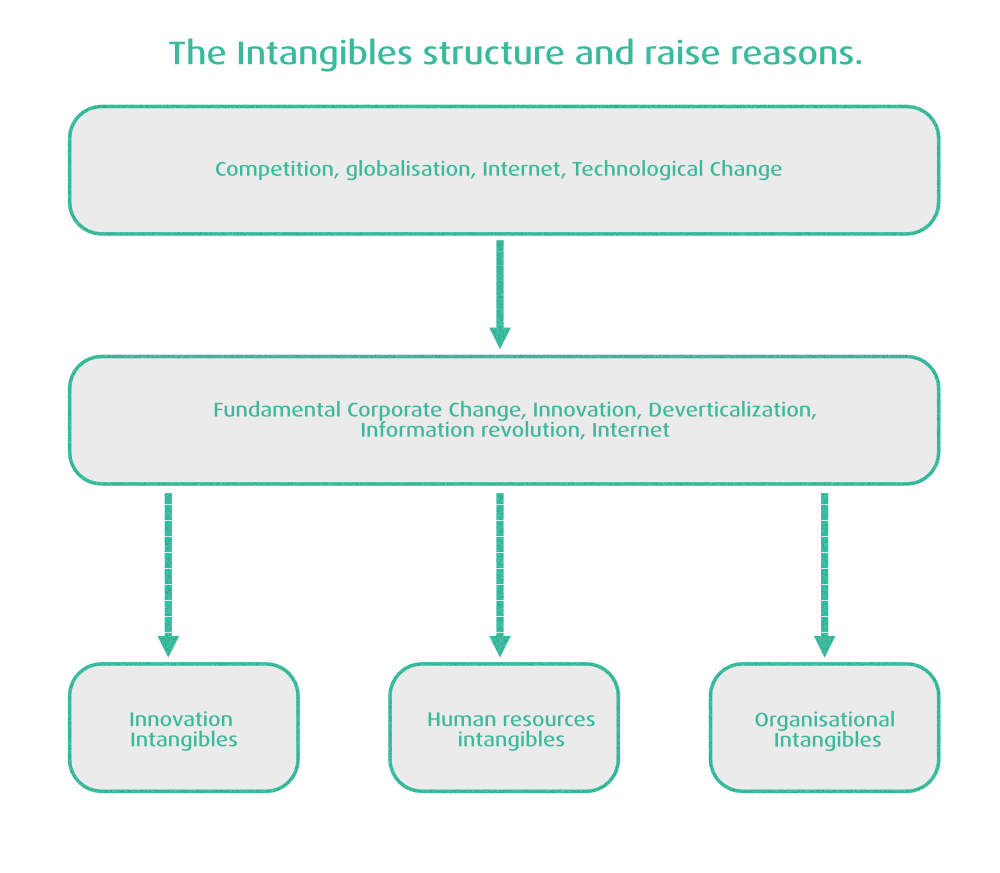

Lev differentiates three nexuses of intangibles - discovery, organisational practices, and human resources.

As Lev work was published around twenty years ago, we can understand that the book value of intangibles rose in the order of magnitude as compared to the 1980s.

The drivers behind the growth of intangibles are the Internet, connected economies, and globalisation. The example he gives is Ford Motor company, which he noted:

Economies of scale for manufacturing cars exhausted well below the scale of total market dominance.

As the company grew larger, the additional manufacturing capacity turned bringing loss, however, the management costs of the organisation grew as well, most likely disproportionately.

That is why the outsourcing took its place, and companies turned towards intangible assets to find new drivers of profitability.

As the competition intensified, so the run for the intangibles became more intense, and the number of workers developing intangibles increased dramatically - 2x between year 1999 and 1980.

If it's so good...?

As Lev notes, an important problem for intangibles is the scale of the market. Many markets have a limited size, or niche is so small not worth investing in them.

But the critical problem is the managerial diseconomies. Managing a physical asset is relatively easy and well-explored. However, some novel code basis itself can be a source of major headaches.

Here we're slowly seeing the risks emerging.

We're not talking about anything shipped yet into the hands of customers, which immediately calls the old rule - that no software survives the first day with customer intact.