As business owners, we tend to look at the Gross profit, and Net Profit, eventually things like Debtors, and Creditors Days.

While these KPIs are essentials, they plug in into a wider context defined as Return on Capital EmployedR (ROCE)

ROCE = Profit before tax / Capital Employed

A simple formula, with a deeper meaning behind. As the author explains in [1], we need to use share capital + reserves + long-term liabilities. All these figures are to be found on your balance sheet.

It is necessary to understand that lenders could be actually funding your business, therefore the inclusion of the long-term liabilities.

Sometimes we can use RONA - which is the same figure, as net assets are the same - fixed assets+current assets less current liabilities.

It is almost a question who teaches you the concepts, but it is clear. Once we compute ROCE periodically, we can see a yardstick indication, especially compared with other businesses in the same industry.

The infidelity in the ROCE is intrinsically given by the historical cost of assets. However, the historical costs may not reflect their real value, and vice versa. Therefore, many zeitgeisty companies could have an inflated or deflated ROCE. Also, many zombie businesses, as we're told by pundits like Peter Schiff, will simply be clinging on for years, as while their fixed asset base has depreciated over time, they will be still showing respectable numbers in ROCE, while they need an external injection of capital just to keep them going. But it is more of a task for stock-market analysts than accountants working for the SME sector.

From my personal point of view, the composition of long-term liabilities does quantify the risks of taking the investments, compared to your own equity.

Enough of my thoughts - for the readers it is better to stay within known means, what we can influence and look again at profit margins and your asset efficiency.

A business can increase ROCE by either increasing profits or decreasing its capital employed.

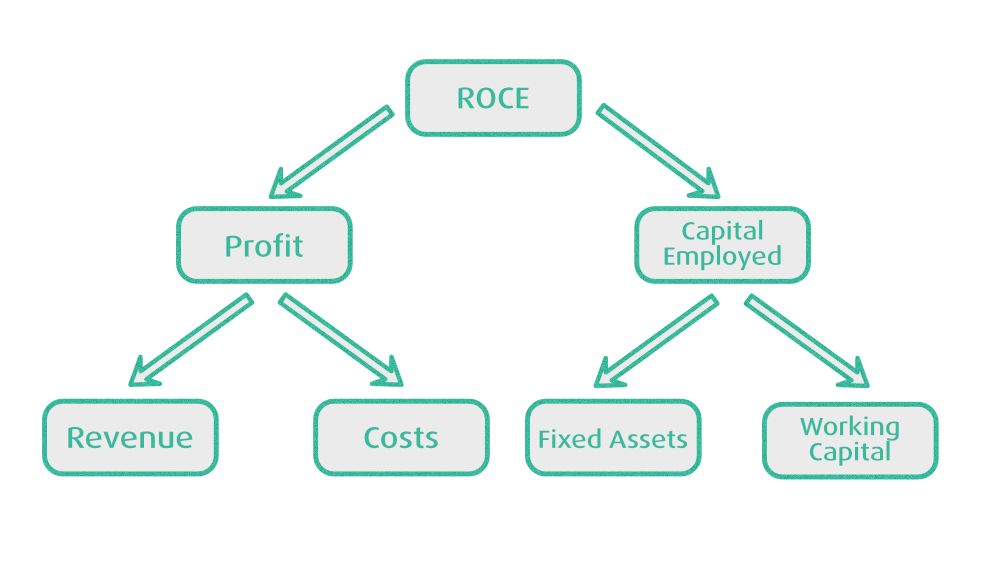

The ROCE is part of a larger picture, which is defined as the Tree of ratios. Looking at 2 roots of the tree - the profitability is one side, and the asset efficiency on the other side.

So as business owners, we need to focus our attention on both sides of the tree - Profit and Loss Report, and the Balance Sheet.

As the author says - how many of us do really so, and how well we are doing this in practice.

As I say in my disclaimer - computing the numbers correctly is a tool, but to interpret them properly for the readers requires experience to be sourced externally.

As our view of the software engineering business is always to know as much as we can about the domain aspect of the product we offer, this is my little contribution towards that goal.

References:

- Mastering Financial Management, Brookson S., 1998, London

- Management Accounting for Decision Makers, Atrill,P. McLaney E. , Pearson Education 2009, Harlow, Essex