Modern business relies on credit, and the majority of the companies offer credit terms to their customers or receive it from their suppliers.

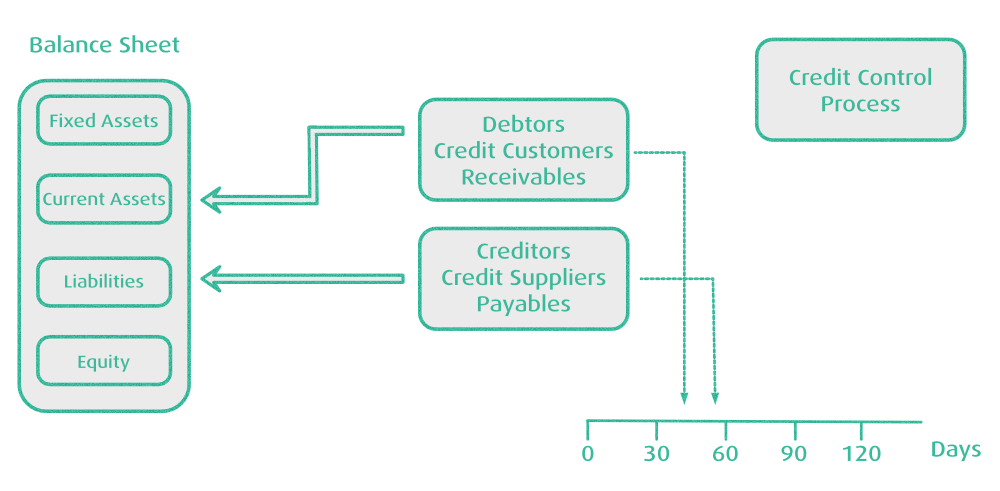

Customers who receive credit are known as debtors or receivables. Suppliers who provide their goods or services without receiving payment immediately are called creditors, or payables.

Debtors are Assets, as they represent money to be received in the near future. The opposite is true for Creditors – they are Liabilities because you have an obligation to pay the received invoice at a later date.

Managing carefully the time to collect payments, and paying bills when due, is a necessity.

It needs to be seen that Debtors are not cash, and they cannot be used to fund immediate cash needs of the business.

Each accounting software needs to allow users to issue or import the invoices and track payments made into Debtor accounts. Once the invoice has been paid by the customer (for Debtors), it gets out of the immediate focus.

Tracking unpaid invoices and their amount outstanding is the most common task to be implemented on any Accounting Software.

The outstanding balances are, in addition, categorised based upon how long overdue they are. In principle, the task can be easily implemented in any programming language or spreadsheet. The mechanisms can differ that either we account for a calendar month "step", thus talking about invoices due, within one month, two months, etc... after due date.

The more simple method is to use 30, 60, 90, 120 days. On a big scale of things, it is a detail, unless you don't have implemented some very strict penalty bands.

From a reporting perspective, the total outstanding balance is the same, but its aged debt categorisation might differ on a particular calendar day, especially at the end of months.

ProudNumbers implements both Debtors and Creditors reports and uses the latter method to calculate Aged Debt categorisation.

Being more practical, it is beneficial to remind ourselves how to manage the outstanding debt:

The process is called Credit Control, and consists of the following steps:

- review a new customer's ability to pay, check credit references, or collect an advance payment

- have clearly stated payment terms in a contractual agreement

- obtain evidence of delivery or confirm the delivery with the customer

- invoice every delivery and avoid part deliveries, as it causes confusion

- invoice promptly at the delivery time

- avoid ambiguity, have invoices with all 9 pieces of information as defined by HMRC

- confirm that the customer received an invoice

- regularly review outstanding balances

- implement a procedure to chase overdue payments - email, phone, letter

- don't hesitate to take legal action if necessary

- use factoring if it is economically viable, and necessary

The business owner needs to plan in detail for bad debt provision, depending on a particular line of business.