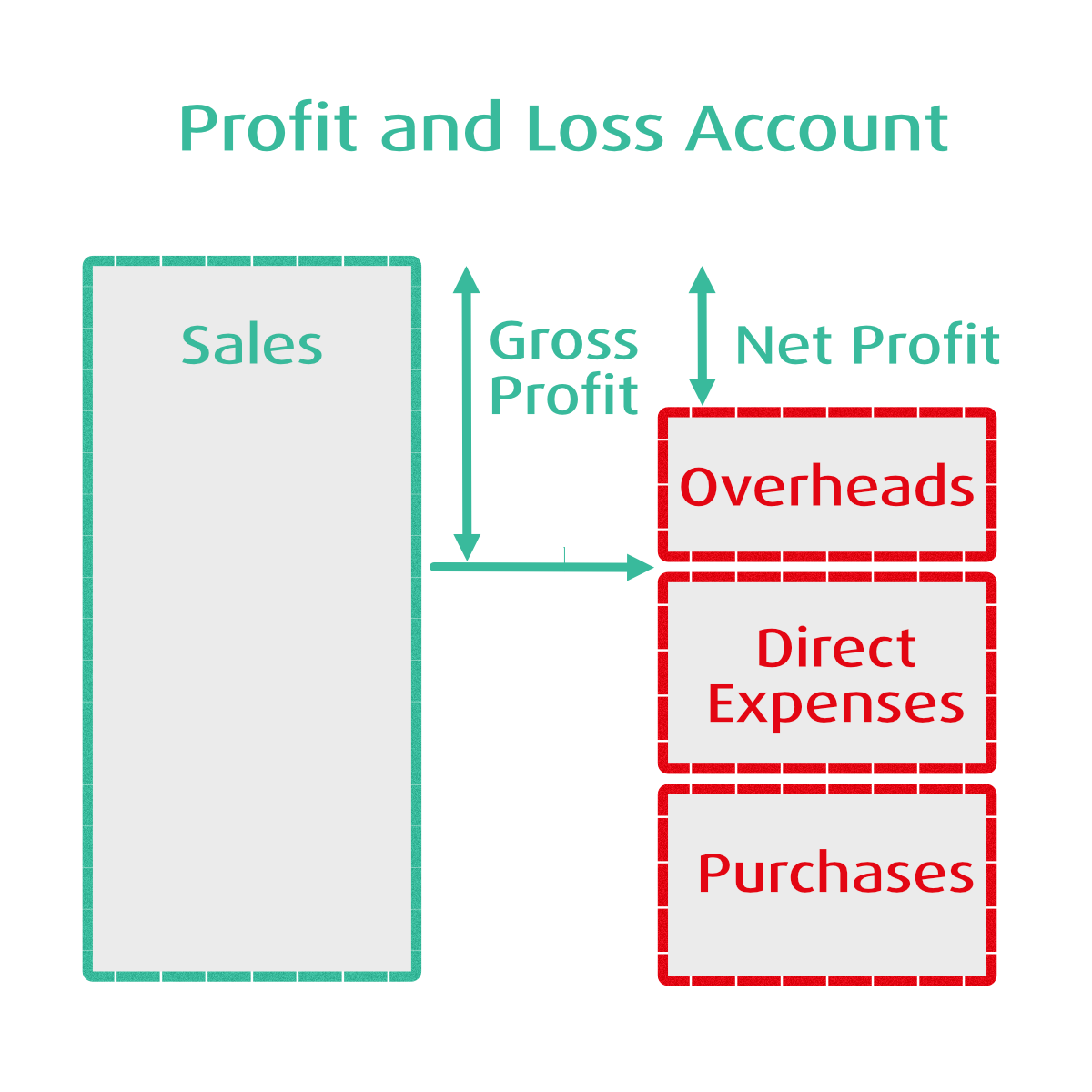

The Profit&Loss statement is a financial report which differentiates 4 main categories to aggregate financial information and getting Gross-Profit, and Net-Profit figures.

This classification is generally well known to SME business owners, and expressing it in relative percentages allows us to compare between different industries.

To understand Profit and Loss, we define the 4 categories and derive the Gross-Profit and Net-Profit figures.

Sales are the easiest part, as it describes the overall volume of activity. It doesn't include VAT.

Sales are the easiest part, as it describes the overall volume of activity. It doesn't include VAT.

As the goods for sales need to be purchased or produced from raw materials, the P&L report contains 2 headings - Purchases of the goods, and Labour needed to be provided to create the product.

Gross Profit is defined as

GP = Sales - Purchases - Direct Expenses

The Gross Profit will provide the raw effectiveness of the 'factory'. The computation itself is straight forward, but as software developers we need to be aware, that Sales are recorded as credits - thus with a negative sign in the database systems representing the number.

However, for presentation purposes, to make it easier for users, we need to flip the sign. The same step but with an opposite sign is introduced for Purchases and Direct Expenses.

As the business needs to account for things like office costs,heat, light and power, the concept of Other costs, or Overheads is introduced.

The distinction, which costs should be treated as Overheads, and where the Direct Expenses could be a question for your management accountant.

For a software business, the software product is intrinsically connected with its marketing, so using the Marketing cost as a Direct Expense is most likely a necessity to keep the contributing factor in the Gross Profit.

For many small businesses, it can be an option to look at Overheads, as a relatively tiny portion, and account almost with a fixed number throughout the year. Some nation's taxation systems allow such fixed overheads.

As we are purely staying with the Management Accounts, I'm suggesting some ways to simplify the implementation of the concepts but stay with the general principles.

The Net Profit is defined as

NP = GP - Overheads = Sales - Purchases - Direct Expenses

As we touched on the concept of 2 operating cycles, we see a problem emerging. Most SMEs perform the continuous interlacing of the Investing and Operating cycles, which could give some headache to decipher the issues.

Add to it the IP valuation uncertainty, and we are immediately seeing that a good bookkeeping system is a necessity and so could be a responsible bookkeeper.

That forces us to define the Nominal Codes in the Nominal Ledger - the transaction identification - in a granularity the business requires.

Each additional complexity brings cost, and needs a careful consideration of what to differentiate.