Understanding the cyclical nature of economic activity is important for many reasons, including own economic planning, business success, and strategy to be chosen.

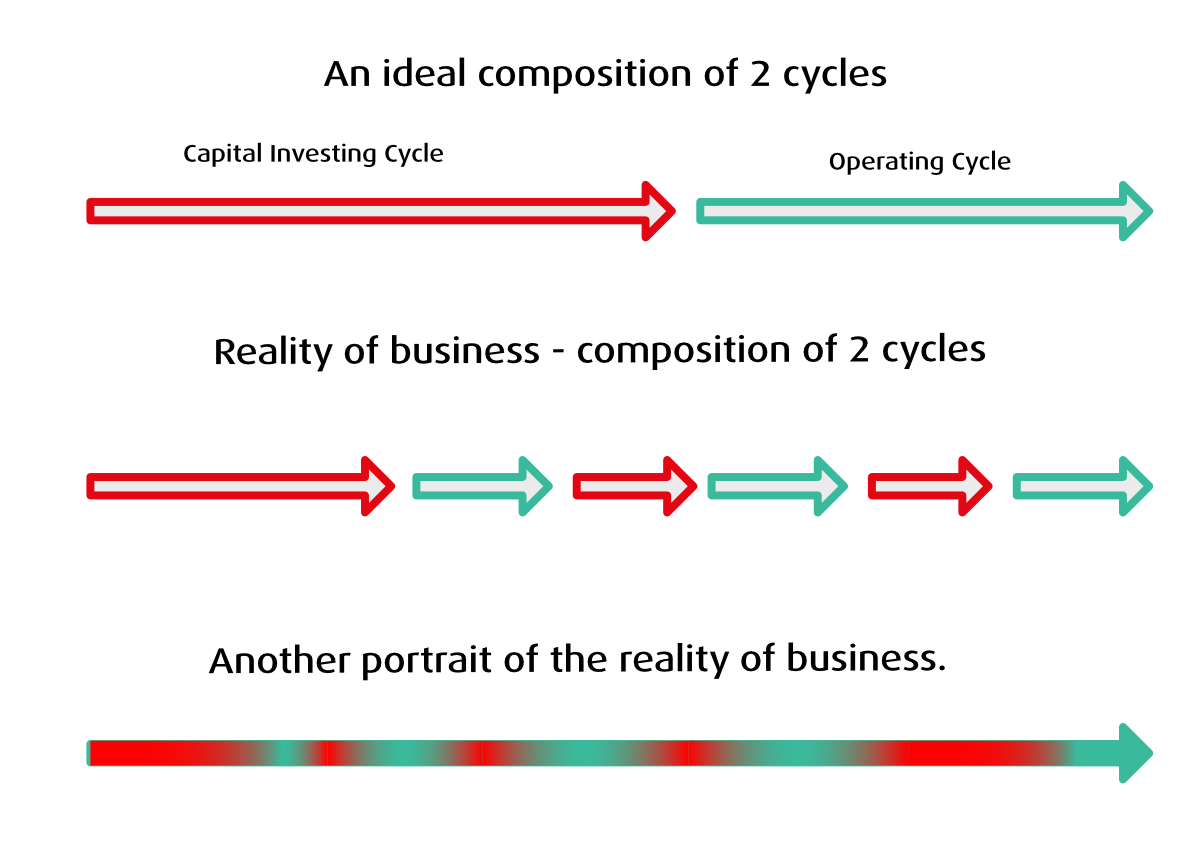

All businesses have two cycles: the capital investment cycle and the operating cycle.

The operating cycle, is straightforward - goods and services are bought in order to sell them later on at a profit. The efficiency of the operating cycle depends primarily on how fast the turnaround of goods and services the company is able to achieve. Obviously, the proportion of bad debts, solvency of the clients, and collection time of the issued invoices will affect the operating cycle.

The capital investment cycle is a measure of how much is invested in the capital infrastructure in order that a business may carry out its operating cycle. A good example is any kind of manufacturing business which needs plant, and machinery ready, in order to execute their production process and operating cycle.

In general, it is expected that the manufacturing business has larger investments into fixing assets, as compared to service-based companies.

My first encounter with this concept was rather late in my 'business' career, when a prospective client concluded that my very good consulting proposal would just take too much of his time, and also reasoned the length of the business cycle as 18 -24 months.

Looking back at various software projects, whether self-invested, or being pursued by companies where I worked for them, the expectation was mostly unrealistic. Just looking at that figure 18 - 24 months, which I fully vouch for, it is evident that the 3-6 months timeframe is just enough to understand the problem statement, or craft some very basic solution, but not more than that. Being asked for a 3-6 months delivery scenario should be a warning sign that the other party needs more information to be aware about the length of capital investment cycle vs. operating cycle.

Again, for the purpose of clarity - these requests I'm talking about are for delivering software products, immediately able to enter the second phase - operating cycle, and being sold on the mass market.

The software micropreneurs (a 1 man company) could be in a little more favourable position, as they are able to work alone, while keeping their job. The prime resource in this area is posts, interviews, and the blog of David Heinemeier Hansson, who is a proponent of this model. DHH elicits 10h per week as a good work-duration investment, which, when sustained for a longer period, can lead to massive progress.

We can think about making the cost of the capital investment cycle cheaper, in principle.

In reality, there is a need to account for the cost of lost opportunity, but these concepts and accounting for them could be dubious.

In the next post of the series, we will look again on IP valuation, incorporating the 2 cycles.