Being stacked into implementation of Cash flow Statement, I got a chance to learn the concept and mechanics myself. All accounting books out there put their attention to this crucial part of financial statements, but each author rightfully points his focus in his own way.

The FRS1, and FRS102 normative gives us a clear picture on how we should report our cash flows from Operating, Investing, and Financing Activities.

The goals to fulfill are twofold:

show cash generation and cash absorption in a well-structured manner

provide information about liquidity, solvency, and financial adaptability

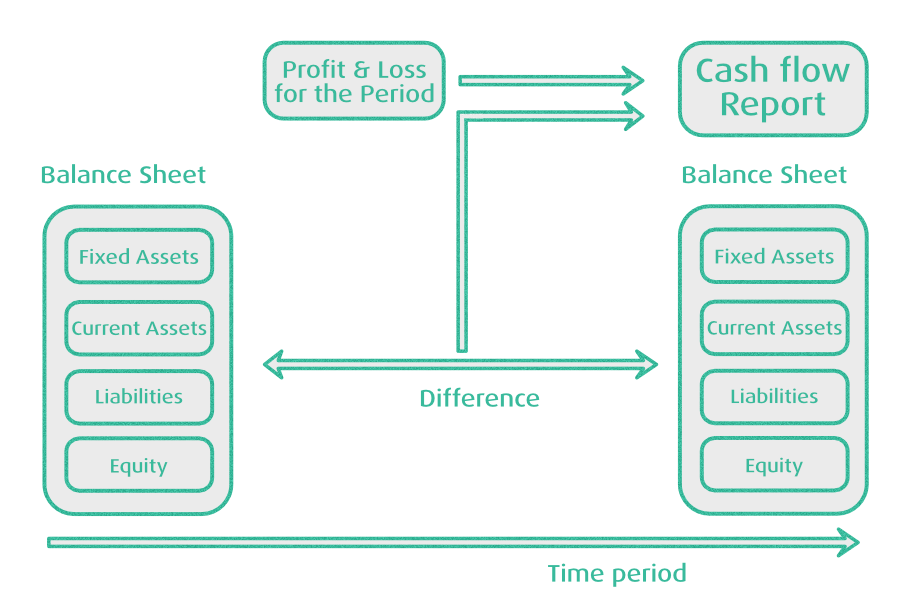

The statement must tally up with the other two parts of Financial Statements

- P&L - operating profit, and net profit, and the movement in net debt from Balance Sheet.

The essence of the statement is to show where actual money comes from and where it goes. The increase/decrease in Stock/Debtors/Creditors is the key to understanding how the Cash flow changes have manifested over the captured period of time.

*The three main categories of the Cash flow Statement contain the following items: *

✅ Cash flow from Operating Activities

Net profit

Depreciation

(Increase)/Decrease in Debtors, Creditors, Stock, and Accruals

✅ Cash flow from Investing Activities

Sale/Purchase of Fixed Assets

Sale/Purchase of Investments

Acquisition of Businesses

✅ Cash Flow from Financing Activities

Proceeds from Issuing Shares

Repurchase of Shares

Proceeds from Issuing/Repayment Debt

Dividends Paid

Loan Interest Paid/Received

As it happens, the structure needs to be carefully adjusted for a particular company. But the principle stays.

In the software, the complexity gets high very quickly. In our software ProudNumbers, the categorisation of the Nominal Accounts needs to be done manually in the beginning, once, using simple Drag&Drop Editor. The nominal codes are colour coded that cash accounts can be excluded, while defining the report categorisation as described.

The described report statement is classified as "indirect" in the FRS102.

The more simple report, which captures only cash flows related to bank accounts, and all other cash accounts, is classified as "direct".

Having seen the description above, you intuitively feel how both reports are the same but different. The first report describes one part of the double entry system—changes on the Assets/Liabitilities/Equity side, the other part purely capturing cash movements in the Bank/Petty Cash accounts.

As always, for more complex business models, you need to adjust your reporting, and your accountants will help with that.

Programming of the complex systems, and achieving a discoverable UI, is a challenging task itself. Sometimes the sums just don't tally up immediately, as somewhere there is a mistake in the calculation. I will share such a story later in this series.

References:

- How to Pass Financial Accounting, Level 4, Smyrniou, O., LCCI Examinations Board, London

- FRS 102, The Financial Reporting Standard applicable in the UK and Republic of Ireland, 2024

- Key Management Ratios, Walsh, C., Pearson, 2004