As the intangible nature of software and its long-term benefits to the business are increasingly recognised, most of the time we need to find some more suitable model to capture these values in our accounting systems.

The facts are certainly well known nowadays, and in most cases to account correctly, you need accountants working in the R&D space, knowing current legislation, and HMRC guidance.

In principle there are 3 phases when recognising the cost of the software project, including R&D.

These phases are

- Preliminary R&D Phase - to be expensed

- Technological Feasibility hase - to be expensed

- Development until Product Release - to be capitalised

- After Release Maintenance - to be expensed.

Now let's little decipher the issue of capitalisation vs expense. In principle, the value, which has been created during a period of Development, can be recognised as a Fixed Asset. Again - this is an intangible asset with no physical existence, but the nitty-gritty of the legislation requires expert in the field. This can be complicated by the fact that UK Legislation allows R&D credit, where some part of the expenditure on development may qualify for tax relief.

The methodology is relatively well-known these days, perhaps 10 - 20 years ago things weren't so ubiquitous as the intangible asset value was not so dominant.

According to literature, intangible asset creates a major part of the balance sheet of the world corporations, and we all witness it.

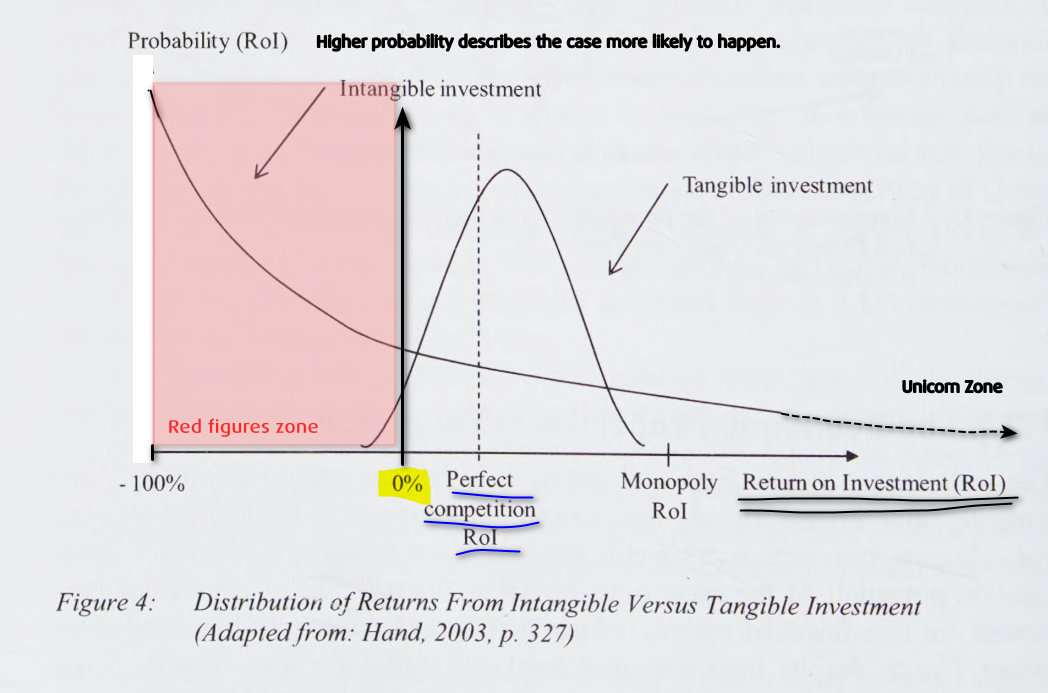

The more interesting part is to look at the risk connected to ROI on the intangibles vs tangible assets.

As we see from the chart below, the probability for the ROI for various levels of ROI can be seen. The horizontal axis describes the level of ROI - by no doubt many projects are a total write-off for 100%.

Unfortunately, the literature doesn't quantify the probability itself, but we can estimate this to be easily around 0.9 or higher.

How to get into positive ROI-s is a completely different topic. As we can read from the chart, the probability of the level of ROI = 0% is also non-negligible.

However, once we pass a Monopoly Level of ROI - we can essentially achieve multiple times our investment back, however, the probability drops significantly as well.

So that is that layman carrot on the stick - a mythical unicorn in terms of business value creation. A gospel of progress, delivering results and making money out of nothing, which is actually a great fallacy. If you don't see something and cannot touch, it doesn't mean nothing, and for example, increasing costs of energy can become very palpable in the AI times.

The investment into tangibles mirrors a bell-shaped curve, and as [1] says, the investment into buildings and machines is at least partially recoverable. I would emphasise the word partially as state dirigisme might make the recoverability very dubious.

References:

- Accounting for R&D Investments, Ordosch, M., Peter Lang, 2012, Frankfurt Am Main

- An Analysis of Application and Accounting Standards to Computer Software and Website Cost, Sharadha N, Manickavasagam V, International Journal of Trend in Scientific Research and Development, Vol. 2, Issue 1, 2017

- Intangible assets, Values, measures, and risks, Hand, JRM, 2003, OUP, Oxford