In my last post about KPIs, we looked at the Return of Capital Employed. Thanks all who contributed to that discussion under post, it helped me a lot in my understanding of the metrics.

The good understanding of the domain helps us to develop quality software faster. The basic mathematics around accounting have been known to me for a long time, but some of the ratio concepts were not so familiar.

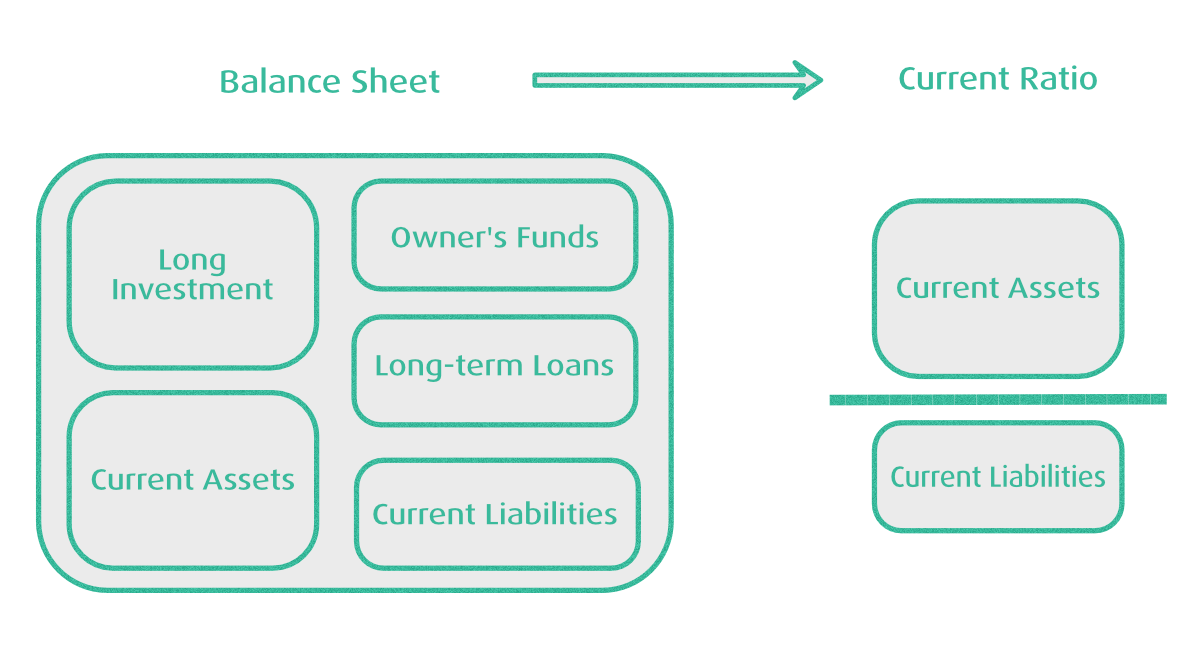

Today I want to share some of the Balance Sheet ratios.

Asset Turnover

This indicates how well an organisation is using its assets to generate sales revenue.

Asset Turnover = Sales / Capital Employed

The ratio is similar to ROCE, but it includes Sales, instead of Profits.

The ratio is very dependent on the type of industry, and service industries should show higher values than manufacturing companies.

The low ratio can indicate that the company is not generating suffcnt revenues in its sales.

Current Ratio

Current Ratio = Current Assets / Current Liabilities

This is an accepted measure of short-term solvency of a company. As part of Current Assets is cash, or assets can be converted to cash in say 30-days, thus allowing that the company can pay its suppliers.

This ratio is a measure of liquidity, which means the ability to meet company obligations. On these forums, we're hearing a lot about problems which SMEs are facing by long payment terms from their customers, especially bigger organisations.

As literature [1] shows, the current assets comprise stocks, debtors, and cash. These factors need to be considered, especially for companies which need to keep stock levels high. Simultaneously, a bad debt will affect this figure, as not taking it into account would show a better financial position than reality.

The ratio is to be expected mostly in the interval 0.8 - 1.5 or wider boundaries of 0.5 - 1.8.

In addition, long credit terms also affect the figure.

Quick Ratio

The quick ratio is based on the assumption that stock will not be recovered quickly enough. Therefore, we need to exclude stock value from the previous calculation.

Current liabilities will therefore be covered from the following sources - debtors, and cash balances.

Quick ratio = Current Assets less Stock / Current Liabilities

This ratio needs to be compared across the industry. As literature suggests, the ratio should not be lower than 1. More than ever, sufficient cash flow management becomes crucial to manage the business effectively.

References:

- Mastering Financial Management, Brookson S., 1998, London

- Key Management Ratios, Walsh, C., Pearson, 2004