The key concept of the Balance sheet is a snapshot of the business assets less liabilities and items of capital. The report as such is less understood as P&L by general business person. Learning more about how to interpret the balance sheet is exciting. Compiling the last few posts gave me an opportunity to learn more about management accounting, as I ever could hope for.

Knowing the internals of reporting for accountants gives us - developers - an exceptional springboard into knowledge about business and how things work.

The accounting convention used is called historic cost. So the value of assets is recorded at their original historic cost. Of course, current values are different and can be recalled for items such as land.

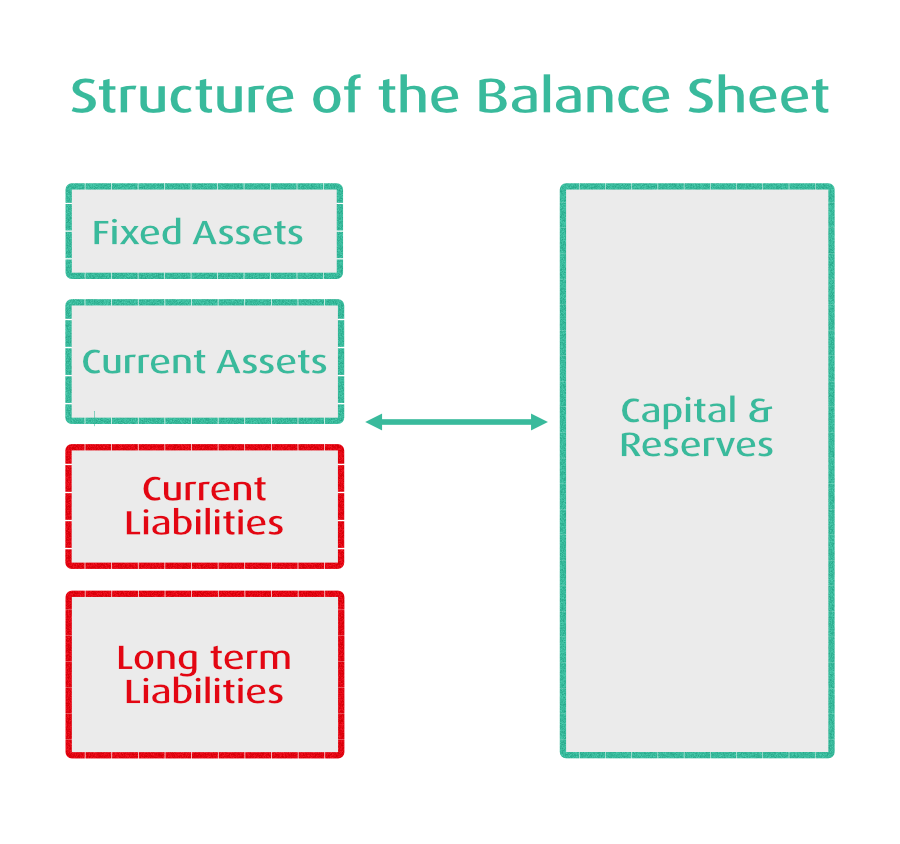

Looking at the structure of the balance sheet, we see the following headings:

- Fixed Assets

- Current Assets

- Current Liabilities

- Long-term liabilities

- Capital & Equity

Discussing the headings on the Balance Sheet we can discuss the following points:

The fixed assets section captures plant and machinery, or other physical or intangible assets which enable company to trade.

The items such as factory tooling lose their value over time, and this process is captured as depreciation. The depreciation is provided to write off the cost consumed by the business over the asset's useful economic life.

The balance sheet shows the historic value and the element of depreciation. In that way we can see the net value of the fixed assets over time.

The main fact to consider is the understanding that depreciation is an intangible value. There are various conflicting myths surrounding depreciation, but for further reasoning, I refer to reference [1].

The best example I came across is the case of aeroplane engines, which could be depreciated according to hours which the engine has run.

The number of hours is strictly tracked, and the maintenance schedule would allow making a precise estimation of the costs associated with each hour flown. As I don't work in that industry, being a flight enthusiast doesn't make me an expert.

The Current Asset Section and Current Liabilities allow us to understand how well the company is working converting its production (or services provided) into cash, and how much capital is actually needed to run the operation.

What should be emphasized is that the term Current actually means within a year from the date of reporting.

The monthly or quarterly breakdown of the balance sheet thus allows capturing unpredictable events, as the outlook for the 12 months of the reporting period can change in our turbulent economy with 2-3 months.

As the professionals understand - the business owner needs to be aware of these uncertainties, as it is already too late when it is being relied solely on the past performance, while we're going through the current financial year.

In the next instalment of the series I will look at the logic around Working Capital, and Capital requirements.