The subtitle from the book [1] by Baruch Lev opens my next post on the series. In the last post we touched the 2 business cycles - investing, and operating.

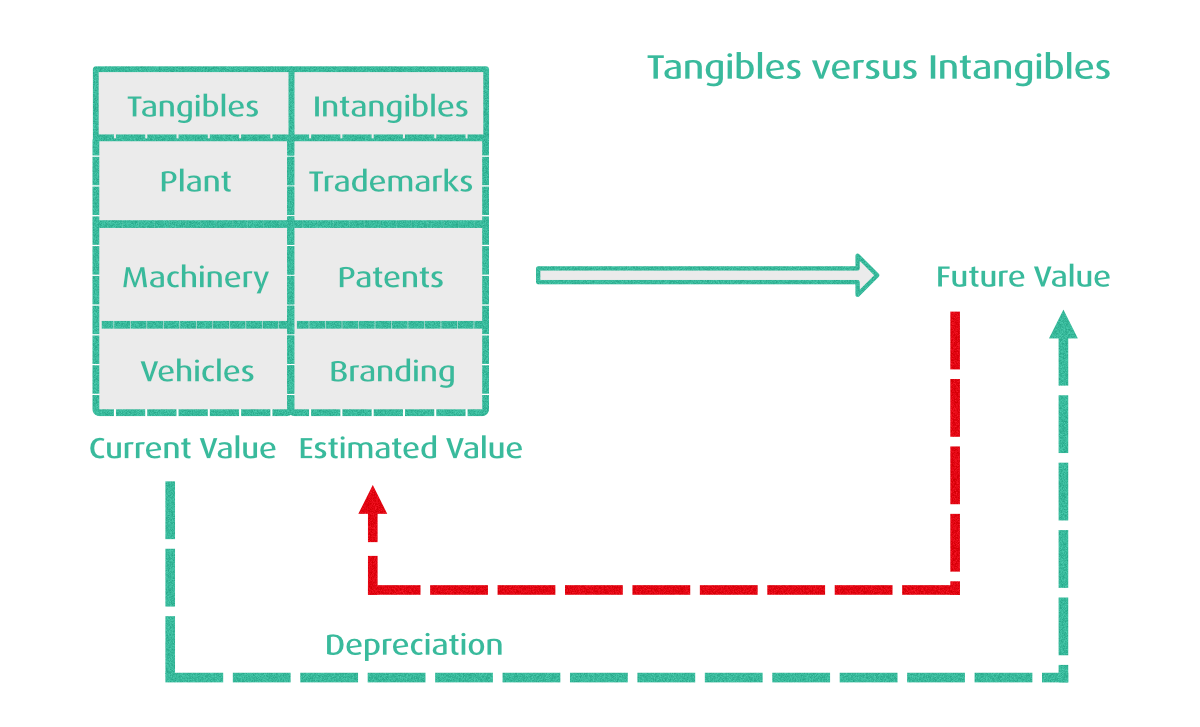

Valuing the intangible product, which may be a result of the investing cycle, and developed by a company during its period, could be a challenge for an investor or analyst.

This claim is the concept of Lev's work, where he argues that the intangible assets are most time valued incorrectly. The intangible's valuation, in the SME scenario, could get more aberrated than in an international corporation.

As we pointed out before, the inherent risk of loss on the investment into intangible asset development can be compensated with higher returns if it pays off. Lev examines a few bigger corporations and analyses their intangible investments. He concludes that investment into basic research brings much better return than other types of R&D - as compared to applied research.

That is pertinent in the SME scenarios, where us as a micro company, a small software development firm, have to be aware of our own capabilities and understand what kind of projects will bring value back. And how much this return could be.

"To know the past, one must first know the future."

This counterintuitive yet profound statement by the mathematician Raymond Smullyan, though not referring to accounting, reflects the essence of accounting measurements, their objectives, and limitations better than any textbook discussion. [1 - pg.81]

Several examples of this big claim make its relevance clearer:

- the net value of accounts receivable depends on the amount of bad debt

- the net value of plant and equipment depends on the validity of depreciation assumptions

- pension obligations rely on long-term projections about future wages increases

In general, the shorter the reporting period is, the less accurate the real behaviour of the company or market can be captured.

That is why very short reporting periods may bring more noise in financial statements` than signal.

The longer reporting periods - looking at three to five years will bring more accuracy in capturing business trends.

Concluding our review on intangibles, it becomes clear that many times we are entering murky waters. A well-known example of epic failure was the Iridium satellite project, which lost around $5 billion dollars before being abandoned by Motorola and partners. It will stay in the history books as one of the biggest intangible failures ever.

For SME microbusinesses, it is important to keep tight control over the project budget and keep working through the investment cycle long term with minimal cash burn, and build further while bootstrapping the business.

What are your thoughts on managing the risks of investing in intangible assets and developing them in your company?

Many ideas in this post are coming from the book and work by the Profit-First Methodology group, also working in the UK.

Their book Profit First is a great advisory source on growth and practical financial management for SMEs.

Thank you to Tim Seymour for sharing the book with us.

References:

- Intangibles: management, measuring, and reporting, Lev, B, 2001, New York